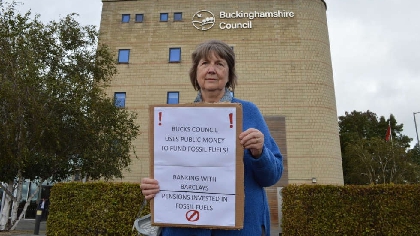

A woman in Buckinghamshire who refused to pay £4,700 worth of council tax in a climate change protest has been hit with another liability order.

Buckinghamshire Council obtained the legal order against 74-year-old Dr Jane McCarthy during a hearing at Wycombe Magistrates’ Court on September 18. Such an order gives a council certain powers to recover unpaid council tax, such as deductions from earnings and benefits, the use of enforcement agents – or bailiffs – and charging orders against a property to recover debts if it is sold.

Dr McCarthy, who has lived in Aylesbury for around 16 years, has withheld around £4,700 in council tax from the last three years in protest at the council’s refusal to stop banking with Barclays due to the bank investing in fossil fuels.

She told the Local Democracy Reporting Service: “For our campaign for Bucks Council to Stop Financing Fossil Fuels I have never disputed that I owe the tax and have always explained that I’m withholding it as a matter of conscience.”

Bucks Council has stressed that its current account banking contract with Barclays was chosen through an open procurement process, which at the time ‘did not include net zero selection questions’.

Dr McCarthy, a mother and grandmother, is part of the Council Tax Strike movement and says she is concerned about the impact of climate change on future generations.

In a submission to the court, she said: “I am withholding my council tax as a matter of conscience as a Quaker owing to the council’s continuing financing of fossil fuels.

“Firstly, by continuing to conduct their banking business through Barclays Bank, and secondly by failing to invest the council tax funds responsibly.

“Both of these matters involve public money for which they are accountable, which the council manages on behalf of the citizens of Buckinghamshire, but their management of this money is failing to include due regard to the significance of the climate and ecological emergency.”

She believes she currently owes the council over £4,700 but could not be sure exactly as the bills do not follow a consistent format.

John Chilver, the council’s cabinet member for accessible housing and resources, said the authority would not comment directly on individual cases but stressed that council tax pays for a range of ‘essential services’.

He said: “As a local authority, we have a legal duty to collect it. Delays in collection or non-recovery of debts leads to high administrative costs and results in lower resources available for vital council services.”

Cllr Chilver also stressed that residents had a legal duty to pay council tax, and that non-payment or delayed payment, was a ‘very serious matter’ that would ultimately be dealt with by the courts.

He said: “We are obliged to recover council tax through usual and legal debt collection methods; 98.5 per cent of council tax was collected in 2023/24 financial year and so it is rare for non-payment cases to go beyond the issuing of a reminder.

“But where cases continue not to be paid, we will issue a final notice and take people to court to obtain a liability order. If payment is still withheld as a last resort, we will instruct enforcement agents.”

Amersham resident donates trainers to installation in dad's memory

Amersham resident donates trainers to installation in dad's memory

Aylesbury Community Big Dig

Aylesbury Community Big Dig

The Clare Foundation invites Buckinghamshire charities to apply for Angels' Den 2025

The Clare Foundation invites Buckinghamshire charities to apply for Angels' Den 2025

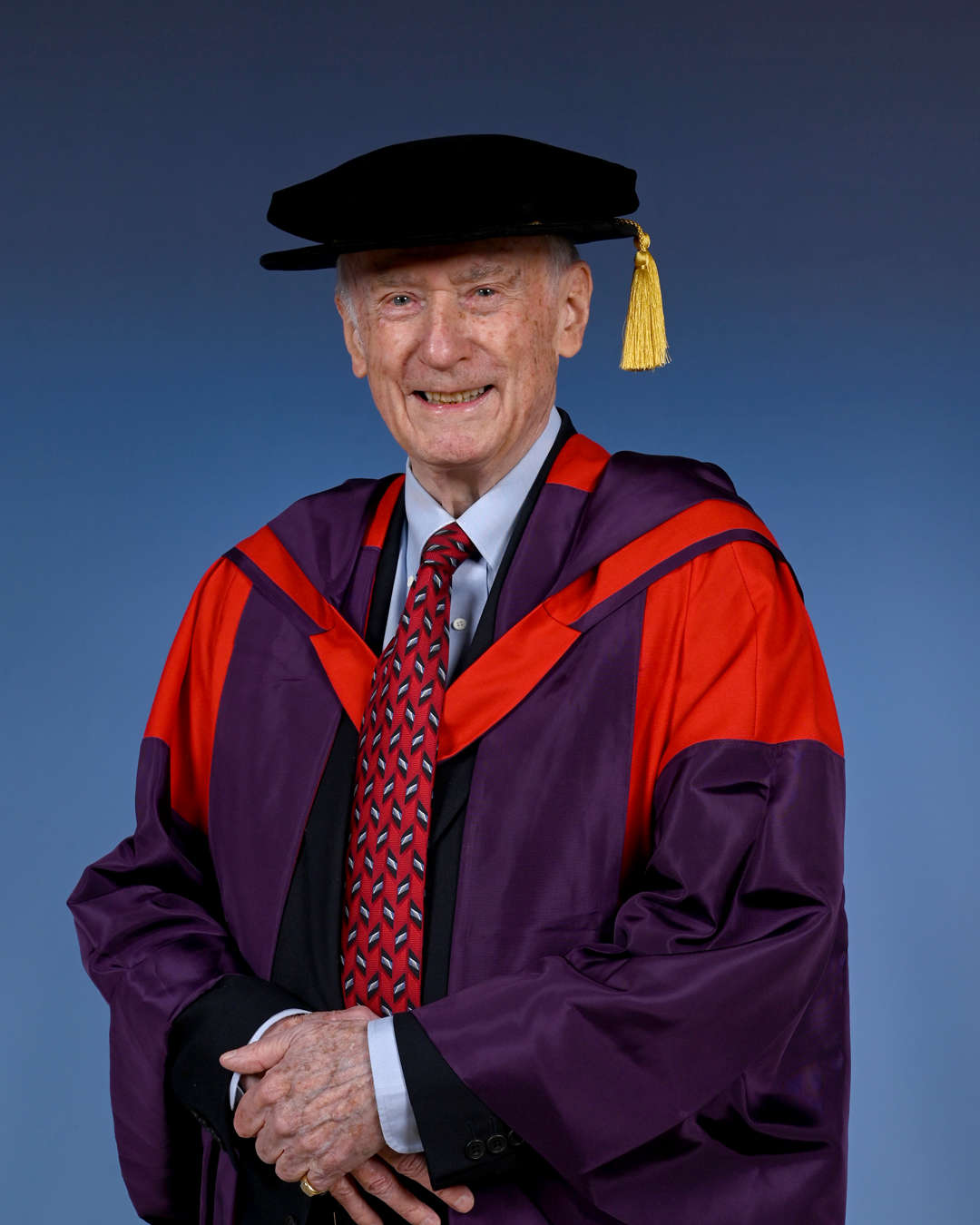

Local Resident is Awarded an Honorary Doctorate

Local Resident is Awarded an Honorary Doctorate

Trust A&E moves into the Top 20 performers in the country

Trust A&E moves into the Top 20 performers in the country

Mursley Community Launches Inclusive Play and Exercise Area

Mursley Community Launches Inclusive Play and Exercise Area

Youth Concern named Waddesdon and Rothschild Foundation’s 2025 Charity of the Year

Youth Concern named Waddesdon and Rothschild Foundation’s 2025 Charity of the Year

Wild about Gardens campaign invites us all to become hoverfly heroes

Wild about Gardens campaign invites us all to become hoverfly heroes